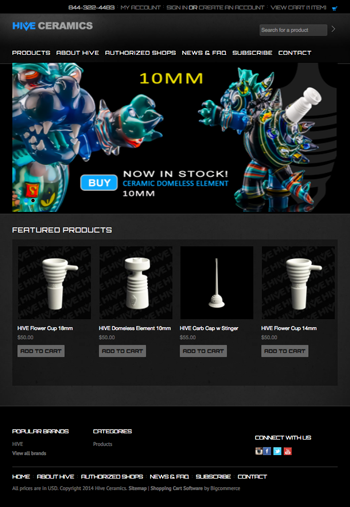

Yes, they have launched an ecommerce site in June:

Are they serious? Over $100 million in shares have traded and THIS is their “investor center.”

Let’s start that analysis:

- The Company has only 8,612,006 shares issued and outstanding as of April 30, 2014. That’s not many. Oddly they have authorized ONE BILLION shares.

- They traded hundreds of millions of dollars in shares, yet had a placeholder page for a corporate web site.

- Just in June announced they have launched a fully functional ecommerce site, although they had sales in advance of that launch.

- They were late in filing their 10Q. Although they filed it only five days after they announced they would be late, that is critical towards damaging shareholders’ confidence.

- Revenue as of March 31, 2014 as just $30,759. I assume that is why they issued the April release about sales, thus showing they have revenues of some substance. They knew what would be in the filing that actually came out on May 20, 2014.

- The Company commented on its revenues in their 10Q: “Vape commenced revenue generating operations and exited the development stage late in the three month period ended March 31, 2014. There was no significant activity during the prior period from March 26, 2013 to March 31, 2013 and thus, such periods are not presented.”

- Lot’s of convertible debt. Read the 10Q and you will see.

- Preferred stock that could become five million additional shares. This from the 10Q: “On April 1, 2014, the Board formally approved the filing of a Preferred Stock Designation in connection with the commitment of 500,000 Series A Shares to HIVE on March 27, 2014 pursuant to its authority to issue blank check preferred stock as provided in the Company’s Certificate of Incorporation. Per the Certificate of Designation (the “Designation”), there are 100,000,000 shares of preferred stock authorized by the Company’s Certificate of Incorporation. The Company is authorized to issue 500,000 shares of Series A Shares pursuant to the Designation. As provided in the Designation (and as set forth in the HIVE Asset Purchase Agreement), Series A Shares are entitled to vote at a 15-1 ratio to Common Stock. Each share of preferred stock shall initially be convertible into one share of common stock (500,000 shares of common stock in the aggregate). On the two year anniversary of the transaction of HIVE, the preferred stock conversion ratio shall be adjusted as follows: a one-time pro rata adjustment of up to ten-for-one (10-1) based upon the Company generating aggregate gross revenues over the two years of at least $8,000,000 (e.g. If the Company generates only $4,000,000 in aggregate gross revenues over the two year period then the convertible ratio will adjust to 5-1). In no event will the issuance convert into more than 5,000,000 shares of common stock of the Company.”

- Had a previous relationship with GrowLife (GrowLife was singled out by the SEC about the validity of press releases. We draw no conclusions on GrowLife.) Details in the 10Q: “On May 14, 2014, the Company and GrowLife, Inc., a Delaware corporation (“GrowLife”) mutually agreed to terminate their non-binding letter of intent (“LOI”) entered into on or about March 17, 2014 for a joint venture into the research and development of patentable technology to create pharmaceutical grade extractions from cannabis (the “Joint Venture”). The Joint Venture was originally announced pursuant to a press release issued jointly by the companies on March 17, 2014.”

Back to the Question: “Can Vape Overcome this Chart?”