Flow International Corporation (NasdaqGS: FLOW)

Flowing water does not make the sexiest of stock stories, so I will try to tell this one without any humor. I hope that’s okay.

As they write in their release, FLOW is “the world’s leading developer and manufacturer of industrial waterjet machines for cutting and cleaning applications.” They’re number one. Enough said, right? That’s reason enough to buy into “the FLOW!” Okay, let’s get some real reasons here.

For the fiscal year ended April 30th and despite not hitting the numbers everyone expected, they did have a new record level of revenue, up 2% for 253.8 million for the fiscal year. That compares to 253.8 million in the prior year. Sales were at an all time high of $239.4 million.

The quarterly numbers did disappoint:

For the quarter, Flow reported revenues of $58.4 million, compared to year-ago fourth quarter revenues of $63.4 million. The Company reported a net loss for the quarter of $1.9 million or a loss of $0.04 per share, compared to net income of $2.6 million or $0.06 per share in the year-ago quarter. The Company’s fourth quarter net loss includes charges specifically related to its Brazil operations, of approximately $2.3 million. These charges include an adjustment of $0.7 million primarily related to inventory, $0.4 million related to an investigation into allegations of employee misappropriation of Company assets, and $1.2 million for tax reserves and higher non-deductible costs under Brazilian tax regulations.

Same question as with KOPN above, why so rosy on FLOW?

The company is undertaking initiatives – as mentioned in the July 31st release – to lower expenses. Additionally, they have more cash on hand with $15.5 million in cash/cash equivalents as compared to the same quarter a year ago.

Some out there don’t like FLOW. Zacks SmallCap Research has it as a SELL.

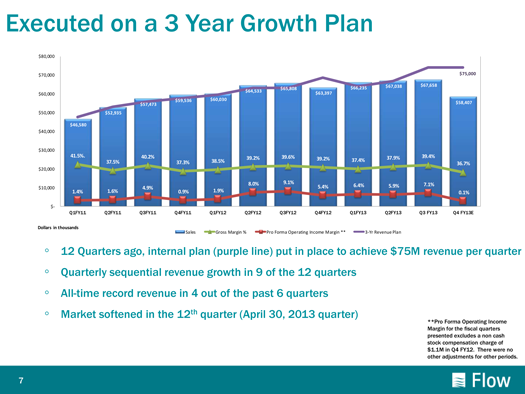

Let’s look at their “growth plan.” This is a slide from the June 2013 presentation on their site:

Company’s often shoot themselves in the foot when they get too aggressive at projecting grown. I like what I see here – until the latest quarter, of course.

Let’s see what President and CEO Charles M. Brown said in the August 1st conference call:

“Three years ago, we put together a plan to drive our quarterly revenue from where we were, about $48 million, to $75 million, generating $10 million of quarterly EBITDA. The fourth quarter that we just reported was the 12th quarter of that plan. For 11 quarters, we tracked very close to our projections and plans, allowing us to continue investing in our strategic imperatives while giving us confidence in our ability to reach our goals. Through 11 quarters, we had sequential growth in 9 quarters and record sales levels in 4 of the previous 5. During that 3-year period, plenty of bad news hit the headlines regularly, ranging from imminent bankruptcy for the U.S. government 2 years ago to the predicted demise of the euro. Through it all, we found ways to grow based on our dual channels of distribution and new products.”

Mr. Brown adds…

“We are aggressively managing our way through a dip in demand. Our business model and competitive advantages remain firmly in place, and our long-term outlook remains robust. Over the past 5 years, we have reengineered our product line, significantly broadened our distribution and retooled our internal systems and capabilities, all funded by cuts in other areas so we did not increase our operating expenses. Having worked through many of these investments, we are now able to reduce costs significantly without compromising our future prospects for profitable growth. When we return to growth, we will enjoy the increased leverage that comes from the lower cost space. Meanwhile, we will continue to carefully manage our way through the current level of orders.”

Basically I see this as an economy issue. I think the Company will continue to perform and will continue to improve. The emphasis I heard in listening to call is that the management gets it and is able to fix it. What they have built today is very strong. Time will tell.

Send any comments about our “Seven Penny Stocks that Could Recover to Prior 52 Week High” to [email protected] – or comment below in the comment section.