RTI Surgical (NasdaqGS: RTIX)

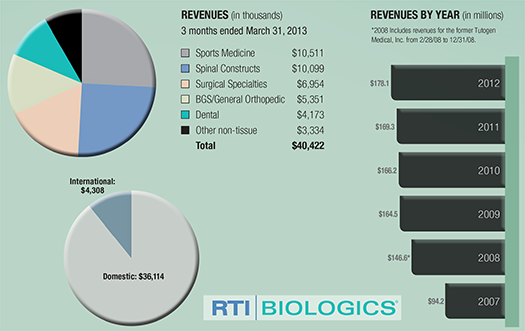

Let’s Get Right to a Revenue Chart. Yes, we know revenue is not everything, and this is from the presentation they created for the quarter prior – ending March 31. Below that I am going to bring in the August 6th update and see how the progress continues.

We’re going to discuss in a moment the overall net loss due to litigation settlements that applied to the period, but it is important to note that 2Q 2013 beat 1Q 2013 revenues.

Back to the litigation and another extraordinary expense, the acquisition of Pioneer Surgical Technology. Read the press release of Tuesday, August 6th. Those expenses are DONE. No more litigation on the 2005 matter will cross the balance sheets. Pioneer is a NET PLUS as an acquired asset. That’s good news. The stock should move up.