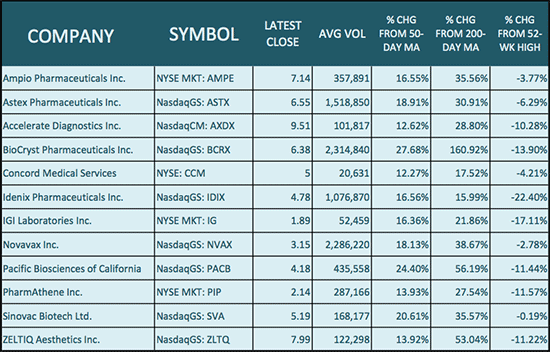

As you can see above, this list is in alphabetical order. The main reason for that will be shown in the two strategies to play biotechs. Never fall in love with a single biotech. They will break your wallet’s heart. Fall in love with a group as those strategies will say, and know when to totally break-up. You will be breaking up about four times per year, FYI.

The reason I am showing the moving averages here is that you need to know that the stock has a forward momentum. The way I have screened this selection is from – number one – already knowing these stocks well. Second – I eliminate those that are not showing some upward momentum. Third I am looking at the recent financials filed and the latest updates they have given by press releases. I have “heard” some of the investor conferences via the transcripts at Seeking Alpha.

I am going to go through these one by one, but I am not going to give you overwhelming detail. I am simply going to give you the information as to WHY a particular stock is in the list. If you look at the strategies you will understand that we are not trying to find love. We are trying to further select a few of these that are most likely to pay-off. How many you play is up to you and your available funds. Three to four is the minimum number in such a strategy, and I will detail how that works later in this post.

We are going to look at these in sets of four alphabetically.