BioCryst Pharmaceuticals Inc. – NasdaqGS: BCRX

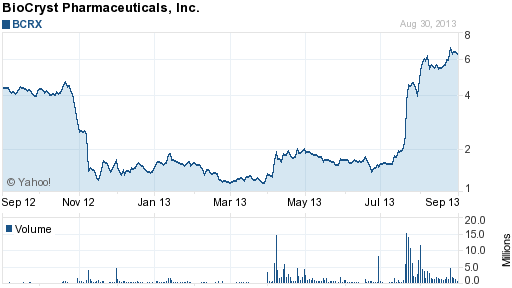

Let’s start with the chart for BCRX:

Normally I look at a chart like that and run. The stock was less than two bucks just six weeks ago and now it is over $6. From it’s June low to its August high this stock was up 360%. That’s incredible for a NasdaqGS stock. Let’s look at why it did that and – more importantly – why we would ever consider it at the current level of $6.38.

Let’s start with a board member buying five million (and two) dollars worth of BCRX on August 2nd as part of the Company’s offering that closed on August 6th. One of hte reasons I like this buy so much is that this insider is paying about three times the price the stock was trading just weeks ago. While he could have certainly bought back then in the market, he was willing to pay the $4.40 price. He dropped a hefty sum of $5,000,002 for this purchase. (Source is at end of the article.)

Another reason – Let’s quote from the August 8th press release from BCRX:

“The fact that we met all of our goals for the BCX4161 Phase 1 trial and secured government funding for the peramivir NDA filing represents a significant step forward for BioCryst,” said Jon P. Stonehouse, President & Chief Executive Officer of BioCryst. “We look forward to initiating the BCX4161 Phase 2a clinical trial and to submitting a peramivir NDA by year end. Our very successful recent financing has allowed us to attract additional high quality investors into the company and has provided us the cash runway to carry us into 2015.”

I would likely hold and not add over current levels. Under the $6.38 current share price I would take small steps and average down over six weeks or so.

A lot of good news can come here, and if it does this will further move up.