[nextpage title=”gold” ]

With our beginners guide to gold investing, we are going to make a couple of assumptions up-front. You want to invest in gold bars, gold coins, gold stocks or gold futures because you think gold is undervalued and has a very significant upside. If that’s your assumption, we agree and will move on to discuss the different ways to invest in gold.

[/nextpage][nextpage title=”gold” ]

Defining Terms:

Let’s define a few terms here that describe the different categories of gold investing. Like I mentioned above, there are several ways to invest in gold.

Here is a short list, but it contains the ways most people invest in gold: |

|

[/nextpage][nextpage title=”gold” ]

If you’re Buying Bullion or Bars:

The first thing to do is to make sure that the gold you are buying really is gold. I share this one article that details how some of the most prudent buyers in New York City were scammed with gold bars that had been hollowed out and filled with another metal. Read about it here.

The first thing to do is to make sure that the gold you are buying really is gold. I share this one article that details how some of the most prudent buyers in New York City were scammed with gold bars that had been hollowed out and filled with another metal. Read about it here.

Obviously buy from dealers you trust. Gold bars are not something you should necessarily buy online. I have often attended coin shows over the years. You find many gold dealers that are really trying to get out of inventory at times. If you are such a buyer, use cash at these shows. The dealer has risks involved if you use a credit card. They know that any electronic transaction can be reversed, so their best price is going to come when you buy with actual cash. Save your receipts when you buy this way. You have to make sure the seller has full contact information, including phone number.

Don’t buy gold on Craigslist for sure. There is too much of a chance someone may be setting you up to rob you.

Buying from the well advertised gold brokers / dealers usually involves paying top dollar. You’re not going to get a “great deal.” Many have plans where you can pay a certain amount a month and you get gold bullion over time.

When you buy from such dealers, some ship to you immediately as you buy gold. Others hold it “on deposit” for you. You have to decide what you like better. Remember, if all hell breaks loose in the economy and you have your gold “on deposit” you might find that your access to that physical gold becomes limited.

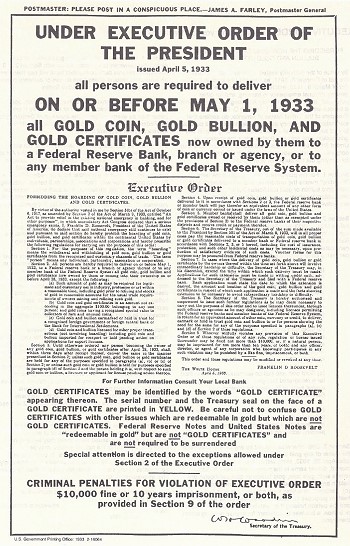

Remember, FDR OUTLAWED PHYSICAL GOLD OWNERSHIP.

Remember, FDR OUTLAWED PHYSICAL GOLD OWNERSHIP.

Could another President do the same? Could that same President block you from taking possession? Food for thought, but highly unlikely. But, if you own gold for when all else goes bad, that may undermine the very reason you hold gold.

If you take physical delivery you could also have it stolen in a robbery or burglary. Don’t share with anyone that you have it in your home. If you take physical delivery and then take it to your safety deposit box at your bank you may end up having access to that box frozen if our economy goes bad. When FDR outlawed physical ownership of gold, he also blocked all access to safe deposit boxes at banks until a government “revenue officer” (prior to IRS Agents) were present as you opened it. That really happened!

[/nextpage][nextpage title=”gold” ]

If You’re Buying Actual Gold Coins Issued by a Government (recent or centuries ago!):

There are three kinds of gold coins, generally speaking:

- A gold coin that is only valued at the price of the gold. It has no “numismatic value.”

- A gold coin that is more valuable than the gold due to its rarity. That rarity is called the “numismatic value.” That is the value of the coin to a collector.

-

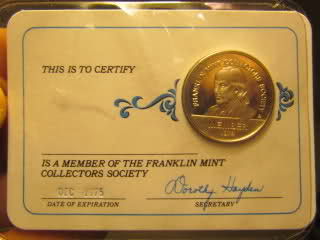

The third kind of gold coin is something that is not actually a coin. These are medallions that are made of gold and sold by private mints. The Franklin Mint is such an example. The Franklin Mint mints both real coins that have a country and a face value or denomination. They also make medallions that look like coins, but are really only worth the value of the metal. They produce “collectors sets” at times of these medallions, but generally speaking they are worth ONLY the price of the metal – no matter how pretty the packaging is.

Unless you know what you are doing, stick with the first kind of coin, those that sell for the price of the gold metal contained within.

Coin dealers will see an amateur coming from miles away. I still like the coin shows best for buying as I have seen it many times where a dealer needs to get out of his gold and get liquid in cash.

When buying from any dealer, get receipts. Get full contact info. Be able to prove where you got it.

[/nextpage][nextpage title=”gold” ]

Buying Gold Stocks:

When buying gold stocks, make sure you understand that there are many so-called “gold stocks” that pretend to be gold stocks. They are actually dreamers or scammers who have not quite got to the gold yet.

Is the gold company producing real gold? Are they also producing other metals at the same time? The latter does not apply to all operations, but if they are not producing anything they are not quite in business.

Gold stocks do not necessarily go up to the price of gold. Let’s say that gold goes from $1000 to $1800 per ounce over a couple of months. The companies that are truly producing will benefit greatly. Those prospective companies are likely to bounce up also – but usually on a false buzz. Rarely is it because they will actually bring in more money.

The Greatly Enhanced Risks of Gold Penny Stocks:

“A fool and his money are soon parted.”

That phrase applied to nearly every gold penny stock. If you buy them, you are almost certain to lose. Don’t believe any report that shows a huge amount of gold in an area that they are about to start mining. Believe only what they have actually brought out of the ground for a year or so.

Most of these tiny companies cannot even begin to actually start production. They use the public company vehicle to hunt here and there for gold. If they actually hit it big, do you really think they are going to share that gold with investors? Think of most of these penny stocks as one man operations that hire a few independent contractors. Let’s say they hit it big in “Area 51.” That’s maybe one of 75 gold claims they have access to and are checking. They just don’t mention it. They let that lease “expire” in a few months, possibly buying that lease themselves.

I don’t trust most of the GOLD penny stock operators. I have heard about fraud where they find gold and that gold ends up going to a privately-owned entity. The expenses of such an operation go to the public company and are put on investors.

Buying Gold Funds – both Mutual Funds or Exchange Traded Funds:

This is the easiest and probably the safest way to buy gold stocks. They generally move with the value of gold. They generally fall before the price of gold actually falls.

This is the easiest and probably the safest way to buy gold stocks. They generally move with the value of gold. They generally fall before the price of gold actually falls.

Exchange Traded Notes for gold companies are not the same as gold equity stocks. It is a debt instrument. It’s more like a utility and less like a gold stock.

[/nextpage]

Click on Arrow to Read More