You’ve likely heard it before just as I have. A company is trading at $0.000ish and they blame the world for not understanding what they are doing. They spell it out in release after release, and nobody seems to get it. The stock goes from something to nearly nothing. It’s time like these that those companies could really use a FIFTH DIGIT behind the decimal point.

Don’t be Critical:

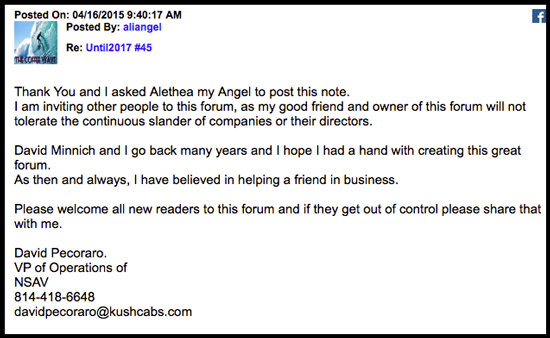

The Company now has a person with the title “VP of Operations of NSAV.” His name is David Pecoraro.

David posted that this morning and someone sent me a link to that right after it was posted. That is the same someone that alerted me to the deals not coming through on NSAV in the past. I mentioned them as an example in my MOU and LOI article I wrote yesterday. In that article I explained that there are so many MOU’s and LOI’s being mentioned in press releases where the deal ends up not happening. Seeing delays and canceled agreements as I have in the past by other companies, I am pointing out one big issue that needs to be addressed by regulators:

David posted that this morning and someone sent me a link to that right after it was posted. That is the same someone that alerted me to the deals not coming through on NSAV in the past. I mentioned them as an example in my MOU and LOI article I wrote yesterday. In that article I explained that there are so many MOU’s and LOI’s being mentioned in press releases where the deal ends up not happening. Seeing delays and canceled agreements as I have in the past by other companies, I am pointing out one big issue that needs to be addressed by regulators:

Regulators must investigate companies that repeatedly use MOU’s and LOI’s in press releases and even 8-K’s, and then don’t come through.

Looking closely at NSAV, what happened to this deal as announced on January 29, 2015?

“Net Savings Link, Inc. is announcing that they have completed their due diligence process, and they have advised their Corporate Counsel to draft a formal definitive merger agreement to finalize the merger with Bella Vida Brands, Inc, an Artisanal food and beverage firm with over 20 years of market presence in the Northeastern portion of the U.S.” (SOURCE)

When I ask what happened, I should point out if this deal is not going to happen shareholders have not been told. If it was important enough to put in a press release then it is important enough to update investors when it does not go through. There is no reference to this deal in any of the public filings. There is not an 8-K to update investors there or a press release.

What About this one on Halloween 2014:

“NSAV Announces the Execution of a Due Diligence Evaluation for Purposes of an Acquisition of an Institutional and Retail Distribution Firm

“Net Savings Link, Inc. (OTC: Pink: NSAV) (NSAV) today has announced the execution of an agreement by our new President, Leonard F. Genovese, on behalf of NSAV, to conduct a formal due diligence evaluation for purposes of a targeted merger/acquisition with a well-established firm that has an entrenched and long term presence in the Artisanal food and beverage/wellness/ and retail distribution space in the Northeastern portion of the U.S., and is expanding nationally.” (SOURCE)

Again – did this deal go through? The Company they planed to acquire does not have any mention of this on their site under news. No PR from NSAV.

They put this in an 8-K dated November 12, 2014:

“On November 7, 2014, we announced the formal execution of a Letter of Intent to acquire Bella Vida Brands, Inc., a firm with decades of deep roots in the Artisanal food and beverage/wellness/ and retail distribution space in the Northeastern portion of the U.S., and which is now expanding nationally.

“ITEM 8.01 – OTHER

“On November 7, 2014, we executed a non-binding letter of intent to acquire Bella Vida Brands, Inc. The letter of intent is subject to the execution of a definitive agreement between the parties. There is no assurance that the parties will ever execute a definitive agreement.”

Okay, so now they have this headline out:

“Net Savings Link Announces Letter of Intent to Acquire a POS Firm in California for the Retail and Delivery Industries” – Accesswire (Sat, Apr 4)

Oops, later than expected.

Then they updated with this:

“NSAV Announces the Signing of a Memorandum of Understanding (MOU) to Finalize the Terms of the Expected Closing” – Accesswire (Wed, Apr 15)

“In our previous public announcement, we had expected to close on the acquisition by April 15, but auditing delays due to the higher than anticipated workflow by the auditors, have necessitated a slight adjustment on our initial expectations. Barring any unforeseen events, we now expect to close by April 20th . . . “

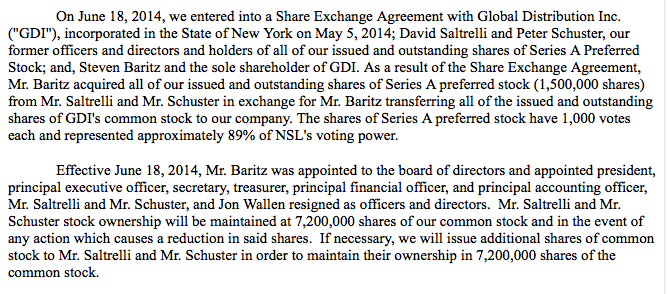

Steven Baritz is not new:

Okay – this company does not like criticism. I read in some of the comments that the new CEO has just taken over and is overcoming the issues from the past.

The only issue I see with that suggestion is that he has been with the Company as President since June 18, 2014.

The problem here is not criticism. The problem is credibility.

Remember, I have been in the smallcap “industry” if you want to call it that for about 13 years. One thing I have learned is never, ever put anything in writing that is not a done deal. I have seen companies that have asked me to mention MOU’s, LOI’s and other potential agreements, acquisitions and more miss either a closing date or simply never get the transaction done at all.

The industry must hold these companies accountable for putting out information that does not happen.

Another issue with pre-announcing a potential agreement:

I have personally seen companies LOSE deals that they pre-announced. What happens when ten shareholders and hour call up a potential company that is the other party to such a deal? They get really, really concerned. Investors often ask, “Are you really doing a deal with XYZZ company?” or “Did you know their shares are only worth 1/1000th of a penny?”

Someone might suggest with NSAV this:

“If NSAV only put out news when deals were fully executed and money (or shares) changed hands, then they would have had no news except about shuffling board members, directors and hiring this new IR VP.”

That would be a true statement. What have they done for the past ten months? Ready the 10-K and its update, and you will see not too much. Is that not the truth?