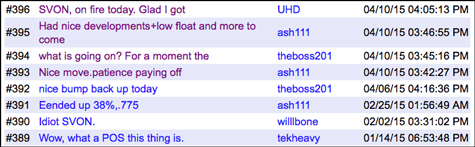

This is kind of a strange one today, Sevion Therapeutics Inc. (OTCQB: SVON). As you can see by the chart, this one suddenly started moving out of no where. It’s as if someone decided they wanted to buy all they could as the day closed out – even if that meant driving the price up as much as 157%. The stock closed up 115.38%.

Here’s the chart:

Here are the trades – note the buying just kept driving the price up:

| PRICE | VOLUME |

| 0.69 | 260 |

| 0.695 | 1000 |

| 0.7 | 3000 |

| 0.7 | 500 |

| 0.71 | 523 |

| 0.7 | 1000 |

| 0.73 | 3900 |

| 0.6801 | 2700 |

| 0.74 | 5000 |

| 0.75 | 5000 |

| 0.72 | 130 |

| 0.794 | 2000 |

| 0.795 | 2000 |

| 0.795 | 1000 |

| 0.8 | 1000 |

| 0.8 | 6500 |

| 0.8 | 4000 |

| 0.85 | 4900 |

| 0.85 | 1200 |

| 0.9 | 25510 |

| 0.925 | 3900 |

| 0.92 | 1000 |

| 0.95 | 9770 |

| 0.95 | 1330 |

| 1.1 | 3650 |

| 1.15 | 1900 |

| 1.17 | 1800 |

| 1.15 | 600 |

| 1.18 | 2300 |

| 1.41 | 2100 |

| 1.5 | 1400 |

| 1.45 | 500 |

| 1.45 | 2800 |

| 1.55 | 2300 |

| 1.55 | 1100 |

| 1.4 | 1300 |

| 1.35 | 350 |

| 1.31 | 100 |

| 1.4 | 5373 |

What could be up?

No news for months. No new filings while trading.

Possibility One: Someone wanted to spend a lot of money for people like us and others to ask this question while they come out with a promo campaign on Monday. Keep in mind, that ABSOLUTELY DOES NOT MEAN THE COMPANY KNOWS OF SUCH A CAMPAIGN AT ALL. Often they don’t. That may not be what this is.

Possibility Two: Alternatively, there could be something huge. Someone knows something and decided he or she needed to grab up shares. That is kind of a dumb way to do it, as it they suddenly cure cancer and ebola, plus build a perpetual motion machine to generate energy, and somebody knew it in advance. Well if that is the case, that somebody would have to explain how they coincidentally made these odd trades and that was announced shortly after.

Possibility Three: Who know?

Recent SEC Filing: SC 13G under Rule 13d-1(c) (Filed March 20, 2015)

The only odd thing that has happened recently is a filing made on behalf of Michael Brauser. It is a SC 13G. He has voting rights or shared voting rights on nearly 10% of the outstanding shares based on the share count as of December 31, 2014. Some of the holding is in warrants and some is in common stock. There is a company he has either control over or some say in that holds shares. Those shares are also part of this filing.

The filing is based on Rule 13d-1(c). This is the one that requires non-affiliates that have voting rights over 10% or greater to file, at least that is my understanding of it.

He has shared voting power over 9.99% of the company, although he is not a director or a board member.

This generally means he is long with the stock. If the stock was dropping rapidly, it is someone holding such a huge amount many might look at. Here, he and those he owns shares with, are positive about the company.

Here are the details from that filing:

(1) Includes 338,667 shares of common stock and 221,735 shares of common stock underlying warrants and excludes 114,932 shares of common stock underlying warrants which contain a blocker provision under which the holder can only exercise the warrants to a point where he and his affiliates would beneficially own a maximum of 9.99% of the Issuer’s outstanding shares (“Blocker”).

(2) Includes 25,000 shares of common stock held by Birchtree Capital, LLC (“Birchtree”), of which Michael Brauser is the Manager, 38,543 shares of common stock held by the Betsy and Michael Brauser Charitable Family Foundation, Inc. (the “Foundation”), of which Michael Brauser is the Chairman, 115,651 shares of common stock held by Grander Holdings, Inc. 401K (“Grander”), of which Michael Brauser is the Trustee, 107,827 shares of common stock held by BSIG, LLC (“BSIG”), of which Michael Brauser is the Manager and 537,853 shares of common stock held by Marlin Capital Investments, LLC (“Marlin”), of which Michael Brauser is a Manager. Excludes warrants to purchase 25,000 shares of common stock held by Birchtree, warrants to purchase 10,579 of common stock held by the Foundation, warrants to purchase 31,739 shares of common stock held by Grander, warrants to purchase 29,592 shares of common stock held by BSIG and warrants to purchase 92,816 shares of common stock held by Marlin, all of which contain a blocker provision under which the holder can only exercise the warrants to a point where he and his affiliates would beneficially own a maximum of 9.99% of the Issuer’s outstanding shares (“Blocker”).

One note on the Blocker Provision mentioned above. That should preclude them from buying additional shares, as they are limited to 9.99%.

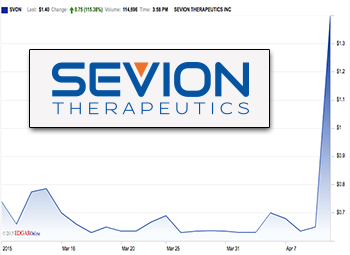

Looking at Ihug:

They seem to be just watchers as well. No one is pumping there. That’s a good thing. That means likely no promoters are likely behind this – although over the weekend ALL of them will claim to be behind this from the start. Don’t believe them.