Stocks to Watch: Facebook and Apple

Apple’s Earnings Report due Tuesday, July 24th

Facebook’s Earning Report due Thursday, July 26th

Facebook (FB), which had a disappointing IPO is about to reveal its first quarterly earnings. Expectations are high to follow the trend of better-than-expected earnings. Facebook’s earnings report is due July 26. Investors also expect Apple (AAPL) to have a better-than-expected earning’s report due Tuesday.

The technology sector has performed better than other S&P 500 sectors and Apple is one of the reasons. The expected growth rate of the technology sector has gone from 6.9% in April to 8.7% as of Friday.

According to Thomas Reuters I/B/E/S, Apples’s earnings are expected to be $10.38 a share compared to $7.79 a year ago. The growth rate of Apple depends on the release of new products such as the next-generation iPhone, the “mini iPad”, and Apple television.

The third generation of Ipad has now arrived in China. The new iPad has a retina display, A5x chip with quad-core graphics and a 5 megapixal iSight camera to capture amazing photos and 1080HD video. The new iPad will still have a 10-hour battery life would be much lighter and thinner and will be priced at $499 in the US for the 16 GB model.

Apple’s next-generation iPhone is expected to have 1GB of RAM, a significant increase from the 512 MB of RAM in the iPhone 4S. The new iPhone is expected to be introduced this fall.

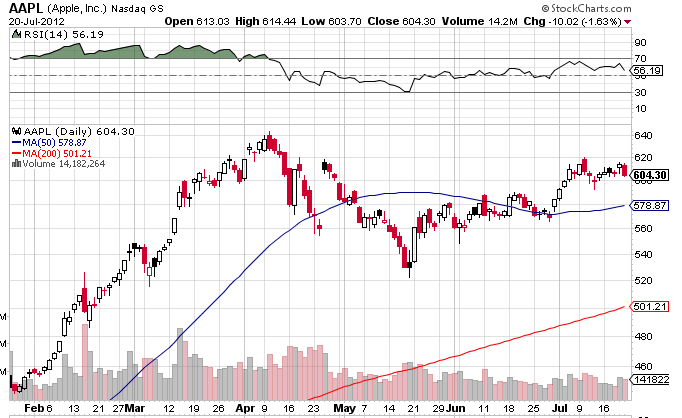

Apple has been trending up, and should continue to do so with a good earnings report. AAPL closed down on Friday July 21, 2012 at $604.30 with 14.2 million shares traded.

After much anticipation, Facebook finally filed its paperwork for its inital public offering on February 1, 2012. During this week, the company turned eight years old. Facebook currently has 845 million users and 3.7 billion dollar of sales revenues last year. And, their IPO raised 16 billion dollars with an IPO price of $38. This valuation was 107 times 12-month earnings. Investors questioned whether the company was overvalued. Also, questions about Facebook’s ability to increase advertising revenue by online and mobile advertising led to a weak market debut. The stock’s price did not have a pop typical of most IPOs as FB’s share price hovered near the inital public offering price on the first day of trading.

Facebook blames the lackluster performance of their IPO on a 30 minute delay in trading due to a glitch in the Nasdaq trading platform, which had an effect on order execution and price levels.

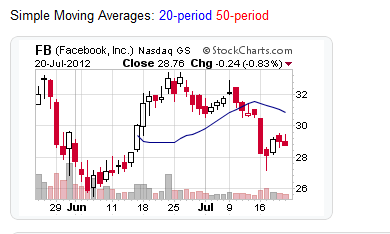

Facebook is trading below its 20 period moving average. Facebook closed down on Friday July 21, 2012 at $28.76 with 11.87 million shares traded. Facebook had a 52 week high of $45 and a 52 week low of $25.52.

Facebook is likely to snap back to the moving average with a good earnings report.

|

|