Turning $4 into $2,885,408

First of all – this likely has nothing to do with anyone at Cybrdi Inc. (OTCQB: CYDI). I just always find it funny when we see a tremendous stock gain on a tiny transaction that’s total value is less than the likely transaction costs at your typical online broker.

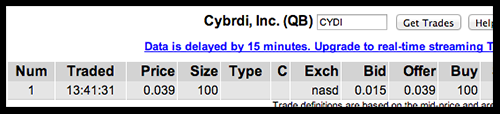

Here a $4 buy likely cost the person another $9 in commission to get just 100 shares of at $0.015 (1.5 cent stock) stock. SORRY – got that wrong. Because they bought 100 shares at $0.039, this is a $0.039 stock (3.9 cent stock).

What does that do to the market cap?

It takes the market cap from $1,803,380 to $4,688,788, and increase of $2,885,408.

How does that help anybody?

In the long run it helps nobody. Sometimes people might be applying for a loan and will show shares of stock as an “asset.” That asset just rose today 160%. More than likely it is a rogue investor who just “feels the stock is worth more” and decided to make that something more show up in the ticker price. Whoever bought it did not do it right at the close.

Another explanation is that somehow only 100 shares executed from a much larger order. That does happen at times, and that is one of the most frustrating things when you are trying to buy or sell a stock that is not terribly liquid. You succeed in getting your price, however, you only get a taste of it – and a commission charge greater than the value of the stock you purchased.

If we assume the transaction cost was $9, then this buyer actually has a cost basis of $0.13 per share. If these are the only shares that this person owns and they decide to sell it Monday to just break even, then they will need to sell them for $0.22 per share considering the commission coming and going.

Likely Reason THIS Transaction Took Place:

The likely reason for the transaction was a shareholder “painting the ticker” so that the stock does not get stuck showing $0.015 too much longer as its latest price.

What exactly does Cybridi do?

From their latest filing:

2. Description of Business

Cybrdi, Inc. was incorporated on August 1, 1966, under the laws of the State of California. From then to approximately June 2004, we conducted business in the distribution of magnetic media products, primarily blank audio and video cassettes. Due to continuing intense price competition and technological changes in the marketplace for its products, the Company lost its remaining significant customers and disposed of or wrote off its remaining inventory. As a result of these occurrences, the Company concluded that its audio and videotape businesses were no longer viable and some of its product lines were obsolete.

In November 2004, we acquired all of the ownership interests in Cybrdi, Inc., a privately held company incorporated in the State of Maryland (“Cybrdi Maryland”). For financial statement reporting purposes, the transaction was treated as a reverse acquisition, with Cybrdi Maryland deemed the accounting acquirer and Certron Corporation deemed the accounting acquiree. Historical information of the surviving company is that of Cybrdi Maryland.

Cybrdi Maryland was established in 2001 to acquire an interest in biogenetic products commercialization and related services entities in Asia. On March 5, 2003, Cybrdi Maryland acquired an 80% interest in Shaanxi Chao Ying Biotechnology Co., Ltd. (“Chaoying Biotech”), a sino-foreign equity joint venture established in July 2000 in the People’s Republic of China (“PRC”), through the exchange of 99% of shares to the existing shareholders of Chaoying Biotech. For financial statement reporting purposes, the merger was treated as a reverse acquisition, with Chaoying Biotech deemed the accounting acquirer and Cybrdi Maryland deemed the accounting acquiree.

Chaoying Biotech is a sino-foreign equity joint venture between Shaanxi Chaoying Beauty & Cosmetics Group Co., Ltd. (the “Chinese Partner”, a PRC corporation) and Immuno-Onco Genomics Inc. (the “Foreign Partner”, a USA corporation). The joint venture agreement has a 15 year operating period starting from its formation in July 2000 and it may be extended upon mutual consent. The principal activities of Chaoying Biotech are research, manufacture and sale of various high-quality tissue arrays and the related services in the PRC.

Most of the Company’s activities are conducted through Chaoying Biotech, of which it owns an 80% interest. Chaoying Biotech, with its principal operations located in China, aims to take advantage of China’s abundant scientific talent, low wage rates, less stringent biogenetic regulation, and the huge genetic population as it introduces its growing list of tissue micro array products.

On February 10, 2005, the Company completed the merger with Cybrdi Maryland and changed its name to Cybrdi, Inc.

On July 26, 2007, Chaoying Biotech entered into an acquisition agreement with the Chinese partner to acquire 83.33% equity ownership of Shandong Chaoying Culture and Entertainment Co., Ltd (“SD Chaoying”) from the Chinese partner for RMB 15 million. The Chinese partner is a principal shareholder of the Company and Mr. Bai, the Company’s chief executive officer, chairman and a principal shareholder, is also a principal of the Chinese partner. SD Chaoying is a corporation organized in the Shandong province of P.R.China. On September 5, 2007, Shandong MOFCOM approved this acquisition and ownership of SD Chaoying was transferred to Chaoying Biotech from the Chinese Partner.

The business of SD Chaoying will primarily focus on culture and entertainment, including make-up, personal care, health club, gambling, saunas for massage and bath, karaoke, catering, and lodging. The Company plans for SD Chaoying to have a specific emphasis on casino gambling, but such operations have not been approved by Shandong Administration for Civil Affairs. At the end of 2010, SD Chaoying had substantially completed the construction of two residential buildings and had recognized revenue from sales of housing units from these buildings for 2010. The main structure of the commercial entertainment center has also been completed, with the exterior, rooftop, the surrounding supporting projects and the community landscaping yet to be completed, but which are expected to be completed in 2014 prior to the commencement of operations by merchant tenants if we can obtain an estimated $3.0 million to complete construction. In January 2011, SD Chaoying engaged Dongshan Victoria Spring Hotel (“Victoria”), which is controlled by the wife of the General Manager of SD Chaoying, to manage and operate the SPA business at the completed section of the cultural and entertainment facility. SD Chaoying has not charged any fees from Victoria and no written agreement was signed. As of March 31, 2014, the Company has not commenced collecting rental and management fee revenue for the culture and entertainment center.

On April 29, 2011, Chaoying Biotech invested $154,732 (equivalent to RMB 1 million) to restore the operation of the Institute of Shaanxi Chaoying Clinical Pathology (“IOSCCP”), a wholly-owned subsidiary established on July 31, 2003, whose main business includes pathology research and consulting, diagnostic clinical pathology and pathology-related research and development of new technologies, and basic training in pathology. Chaoying Biotech has been its sole shareholder.