Idenix Pharmaceuticals Inc. NasdaqGS: IDIX

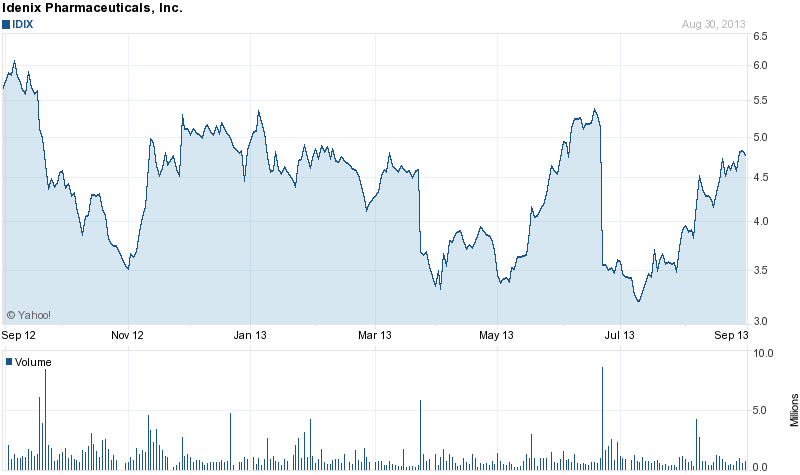

This is one high beta stock. The swings are notorious here, and you would likely not buy at current levels if you were ONLY looking at the chart:

Quoting Ron Renaud, the President and CEO for Idenix, from the August 7th release:

“In the second quarter, we saw significant progress of our lead HCV development program, samatasvir, and continue to be on track to report data from the first patient cohort in the fourth quarter of this year,” said Ron Renaud, Idenix’s President and Chief Executive Officer. “We remain committed to our HCV nucleotide franchise, and we are actively pursuing additional paths forward with the ultimate goal remaining the evaluation of an all-oral internally developed pan-genotypic combination regimen including samatasvir and a nucleotide inhibitor.”

In reading bullet points from that same release, we see that there have been no “treatment-related” serious adverse events in the clinical data to date. I hope there none serious at all.

They gave some upcoming info:

- Rates of sustained virologic response measured four weeks after the end of treatment (SVR4) will be available for the first cohort of patients in the fourth quarter of 2013.

- A second trial (HELIX-2) of samatasvir, simeprevir and TMC647055, a once-daily non-nucleoside polymerase inhibitor boosted with low-dose ritonavir being developed by Janssen, is expected to begin enrolling genotype 1 or 4 treatment-naive HCV-infected patients in the third quarter of 2013.

This one is higher risk at current levels. It does fit into the overall strategy that we will discuss after I introduce all twelve companies.